Should you do a balance transfer?

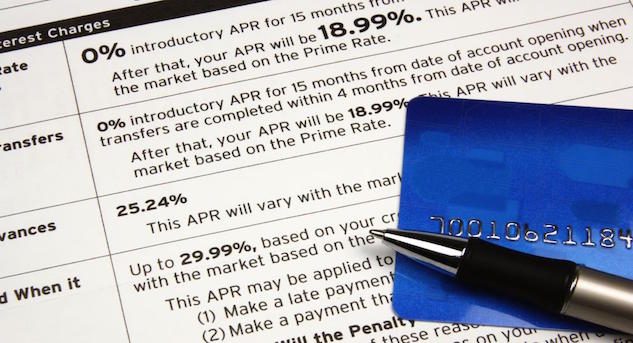

In the last post I talked about getting your credit card interest rate reduced and briefly mentioned balance transfers. Well today I’m going to get a little more in depth and touch on the things you need to know when considering them. You might get these offers in the mail and just trash them without even opening them. The basic idea here is you move your credit card balance from one card to another card that has a lower interest rate. Usually when you get the offer in the mail the interest rate is very low, sometimes as low as 0%, to entice you to move your balance.

Sounds easy right? It actually can be that easy but there are a few things you should keep in mind when deciding whether to take a balance transfer offer:

- How long is the promotional period with the low interest rate?

- Is the promotional interest rate significantly lower than the existing rate you have with the card you are moving the balance from?

- All of credit card companies charge a transaction fee for accepting these balance transfer offers. The fee usually ranges anywhere from 1-4% of the balance being transferred.

- What will your interest rate go to after the promotional period ends?

- Your monthly principal payments will be applied to your promotional balance first. This is the catch with these offers. Say for instance you already had a balance with Credit card B of $2000. Then you get this offer in the mail and decide to transfer the $3000 balance from your other credit card. Every time you pay on your credit card, the principal portion of your payment is being applied to the promotional balance of $3000. That means the $2000 balance is going to keep accumulating interest at whatever the normal rate is on that card. It will not be touched until you finish paying off the promotional balance.

After you’ve taken the above things in consideration, if you feel confident you can pay off the balance before the promotional time period expires then go for it! Especially if you feel it would save you a lot in interest. Have you done one of these offers in the past? Share your experience below.

- February 22, 2017

- No Comments

- 0

- balance transfer, Credit Card